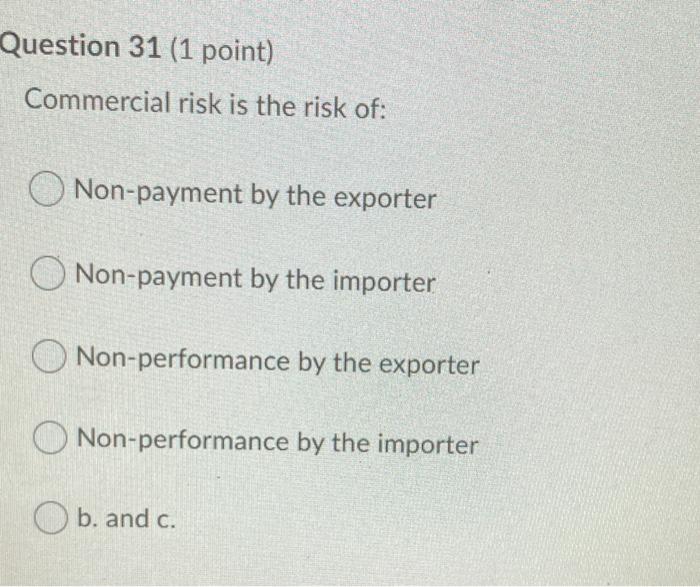

How much away from a mortgage Should i Rating Having a beneficial 650 Credit history?

The borrowed funds amount you can purchase with a great 650 credit score is mainly established your earnings, nevertheless credit history may also have an impact given that interest pricing, which their approval number is additionally tied to your credit ratings.

Which have a 650 credit score, you could qualify for certain mortgage options, also FHA, Va, and you will old-fashioned loans with many loan providers, although their price could be partially influenced by the borrowing score and you can downpayment.

Financial which have good 650 Credit history

Applying being acknowledged for a mortgage which have an excellent 650 credit rating is possible. This fair get get meet up with the lowest standards of some lenders, especially for You.S. government-recognized mortgages.

However, doing this comes with the unique pressures. With a beneficial 650 credit rating, you may not meet the requirements you to discover the best-offered rates of interest because of the relevant credit chance. To play it, examining their credit reports when it comes down to inaccuracies and you will handling bad scratches increases your odds of securing a favorable financing price. Once you understand these items, let’s look into wisdom your credit rating best.

Yes, you’ll be able to secure a home loan that have a credit get off 650. While you will most likely not be eligible for a minimal rates of interest, discover selection like FHA funds, Va money, or USDA financing that complement so it Alpine loans credit score range. In addition, trying to improve your credit rating before applying can potentially effects much more good mortgage terms and conditions.

Insights The 650 Credit rating

Very, your credit rating are 650. So what does that mean precisely? Better, a credit history informs loan providers just how reliable you are during the repaying lent money. A get off 650 sets you from the Fair class and you may falls underneath the national mediocre out of 710. But what really does which means that so you can get a mortgage?

With a reasonable credit history setting certain lenders you will envision you entitled to a mortgage, especially if it’s backed by the newest U.S. regulators. not, you will possibly not qualify for the best interest rates offered. It shouldn’t deter both you and it is vital to learn for which you stand in order to bundle properly and possibly make changes when the needed.

Affairs Affecting Your credit score

Credit ratings are affected by individuals facts, in addition to commission record, borrowing usage, amount of credit score, the fresh borrowing, and you may credit merge.

- Payment history: Here is the number of one’s towards the-date money in addition to any non-payments, selections or overlooked money.

- Borrowing utilization: They is the percentage of the readily available borrowing from the bank you are already using.

- Duration of credit rating: So it foundation takes into account the length of time your own levels was basically unlock and you can productive.

- The credit: After you submit an application for the brand new loans, it does a little reduce your get because of the associated hard concerns additionally the prospective chance of over-credit.

- Credit blend: Which have different varieties of borrowing from the bank such as for instance repayment fund (age.grams., car and truck loans) and you can revolving borrowing from the bank (elizabeth.g., playing cards) can be seriously effect your score.

For-instance, imagine someone has had a few financial hiccups in the past. They experienced certain unforeseen costs one led to delinquency on the credit card debt regarding 5 years ago. However, ever since then, they’ve got handled a clean record no after that delinquencies. For example a track record can be shown within their rating however, doesn’t explain their capability to pay back a mortgage.

The credit utilization describes how much of your own borrowing limit youre playing with. The aim is to ensure you get your borrowing utilization less than 29%. By way of example, in the event your charge card limitation is actually $step 1,000, then you definitely wanted what you owe less than $300 at all times.