Whether you’re the only buying a home or perhaps the you to definitely co-signing for someone else, shortly after there was an agreement on home, both you and the fresh co-signer will done a proper application form on the financial, signal they and present it on the mortgage broker or loan manager, together with other documents, instance agreement to verify the a career, money and you will credit history. But the procedure try away from over at this aspect. You to definitely bank associate commonly ask you to answer a slew away from issues, in https://cashadvanceamerica.net/installment-loans-co which he otherwise she will get contact your plenty of minutes that have inquiries through to the assets buy or payment date. Loan providers does their research and constantly be certain that your income, costs, property or any other circumstances that can impact your ability to expend the loan until the most hours your close the deal to the the home. Even throughout the lifetime of the loan, the loan business is capable of doing a credit assessment out of time and energy to time and energy to be sure you is also always generate money with the financial.

Creating your day you and your pal, partner otherwise companion choose the assets, you might be legally guilty of property taxation provided their label is on the newest action or name. Thus, it is very important remain a copy of your own package you and the co-signer drew upwards inside a safe place, if the you desire arise to refer to they.

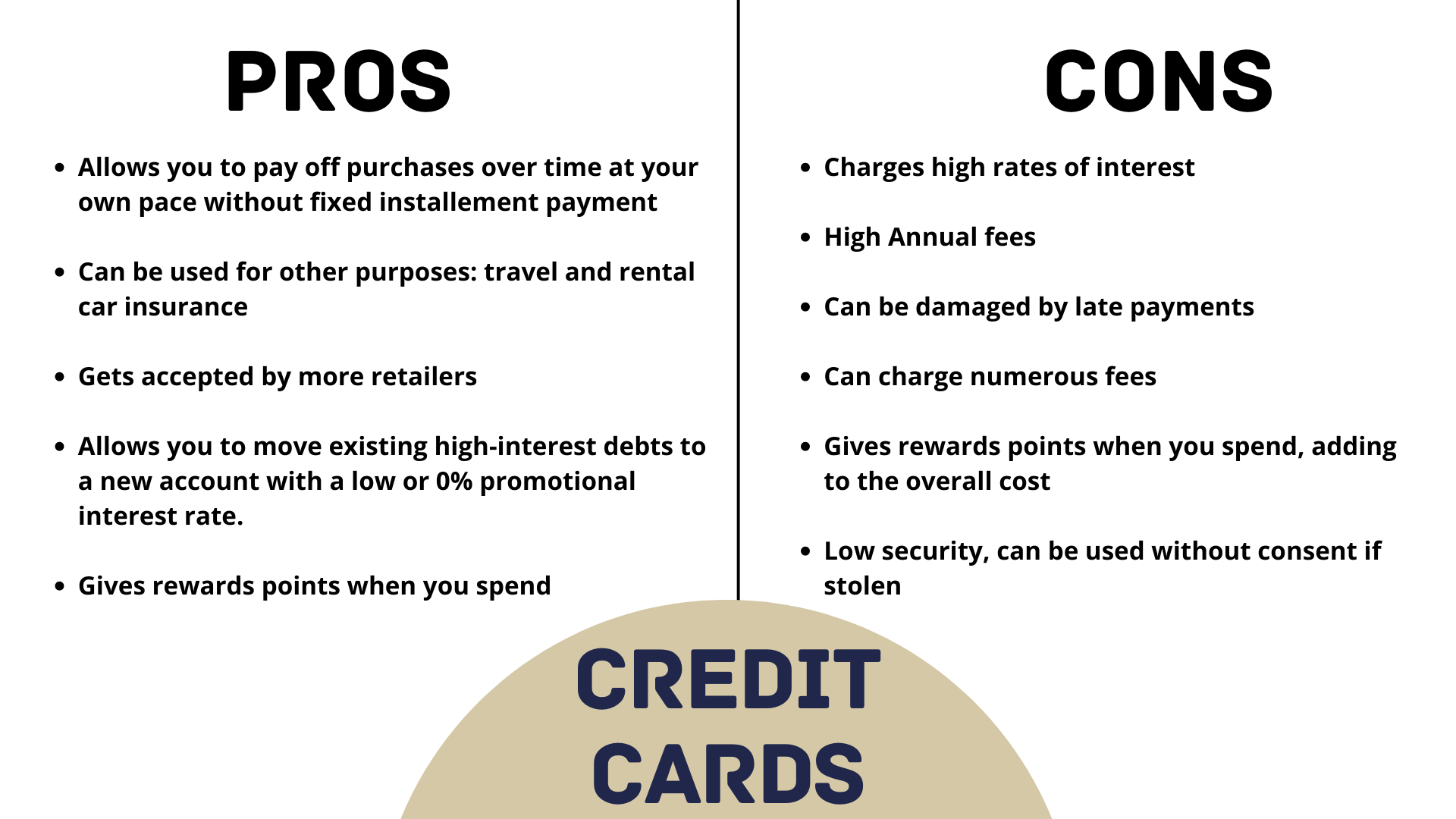

While we discover before, there are mixed feedback to the thought of financial co-signing. However, there is pros — mostly to your primary debtor — regarding co-finalizing, one thing can go completely wrong and construct more than a headache having either-or both somebody. Weighing the pros and you can cons of co-signing before you can actually ever place your signature on that first mortgage file allows you to make the top decision for the lifestyle and you will monetary upcoming.

Like, in the event the no. 1 debtor doesn’t generate costs or makes them later, it goes contrary to the additional borrower’s credit history as well

There are a number of circumstances in which a guy will want otherwise require good co-signer. Naturally, a married couple create normally co-indication to possess a mortgage. But there are many times when a borrower must seek a beneficial co-signer. She or he might have weakened credit, a premier debt-to-money (DTI) proportion otherwise an unstable occupations history. Such as for example, a first borrower may have been divorced for a number of age, but their name’s however for the mortgage of the home in which their ex lover-spouse life. Or, it could be someone who submitted bankruptcy proceeding previously owed so you’re able to an economic catastrophe and is now taking back toward his feet. A lender may need an initial borrower to possess the next borrower who may have able and committed to guaranteeing the borrowed funds was paid back. There are also specific individual intentions a guy have to have attempting to back-up someone’s guarantee to spend a mortgage — and most ones relate to providing a pal otherwise relative.

At the same time, the borrowed funds could well be factored towards the secondary borrower’s DTI ratio that can prevent your ex partner out of to find most other assets or delivering almost every other fund

Yet not, there are reasons to look out for co-finalizing home financing, whether or not you may be trying to lend a hand in order to a cousin or a pal. Possibly the ideal-put plans can go wrong and you will wreak havoc on you to otherwise each other consumers. Imagine the key borrower helps make the mortgage, tax and you may insurance costs, together with will pay the fix costs for many years. Next, instantly, the new co-signer pops up and you will desires to kick the latest debtor of the spot, needs 50 % of worth of the house, or unbeknownst on the first debtor, uses the home because collateral for another financing. Talking about terrible-instance issues to the no. 1 borrower. Usually, those individuals other the thought of co-finalizing indicates some body facing doing so because of exactly what do wade completely wrong with the co-signer.