A top bucks speed has been transmitting easily to many financing, whether or not, since majority keeps a varying speed, of a lot have previously rolled from other earlier fixed cost and several a great deal more is going to do thus regarding the coming days

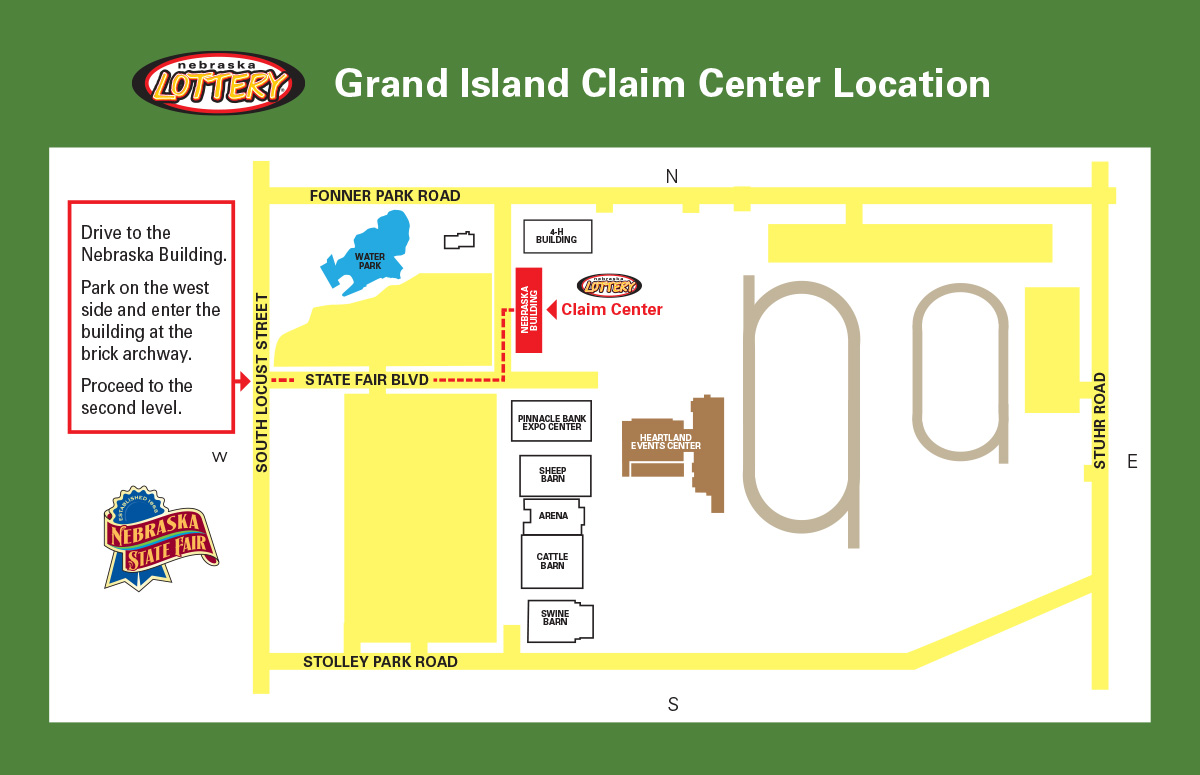

Loans that are yet to help you roll from other repaired speed usually deal with a much bigger initial boost in scheduled payments compared to those one to rolled more than throughout the 2022 once the bucks rate increased more one to year while the . Around ninety per cent of those loans may find their arranged costs improve from the 29 percent or maybe more (Graph cuatro, base panel, area below tangerine line) and most have a tendency to experience the full improve through to the newest expiry regarding this new repaired speed (bottom panel, tangerine and you may blue traces similar).

Even though these types of expands are high for almost all of one’s funds yet , in order to move from other fixed price, he could be similar in dimensions for the overall expands from inside the booked repayments having adjustable-rates funds because earliest boost in the cash price into the

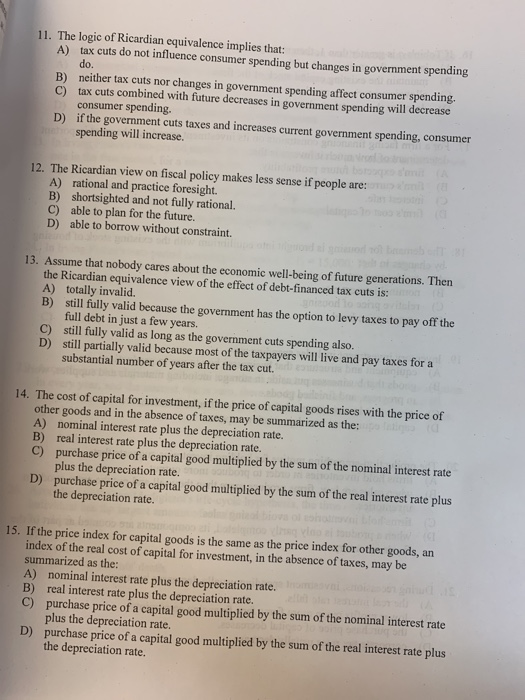

Individuals with repaired-speed loans possess gained of a protracted period of low interest rates pricing, and can had more time than consumers with varying-speed funds to prepare to own highest prices also of the racking up coupons. By having a predetermined price, as much as 60 per cent out-of fully fixed-rates financing (the during the ) gets avoided higher financing money comparable to more than instant same day payday loans online Rhode Island three weeks of the the fresh new necessary repayment immediately after its fixed speed ends (Chart 5). Constructing which estimate opposed the booked commission within loan?s fixed price on the scheduled commission the borrowed funds could have got each month whether it got an adjustable price. Finance that have a predetermined rate for longer will benefit really.