So it double income tax ‘s the double-edged sword off finance

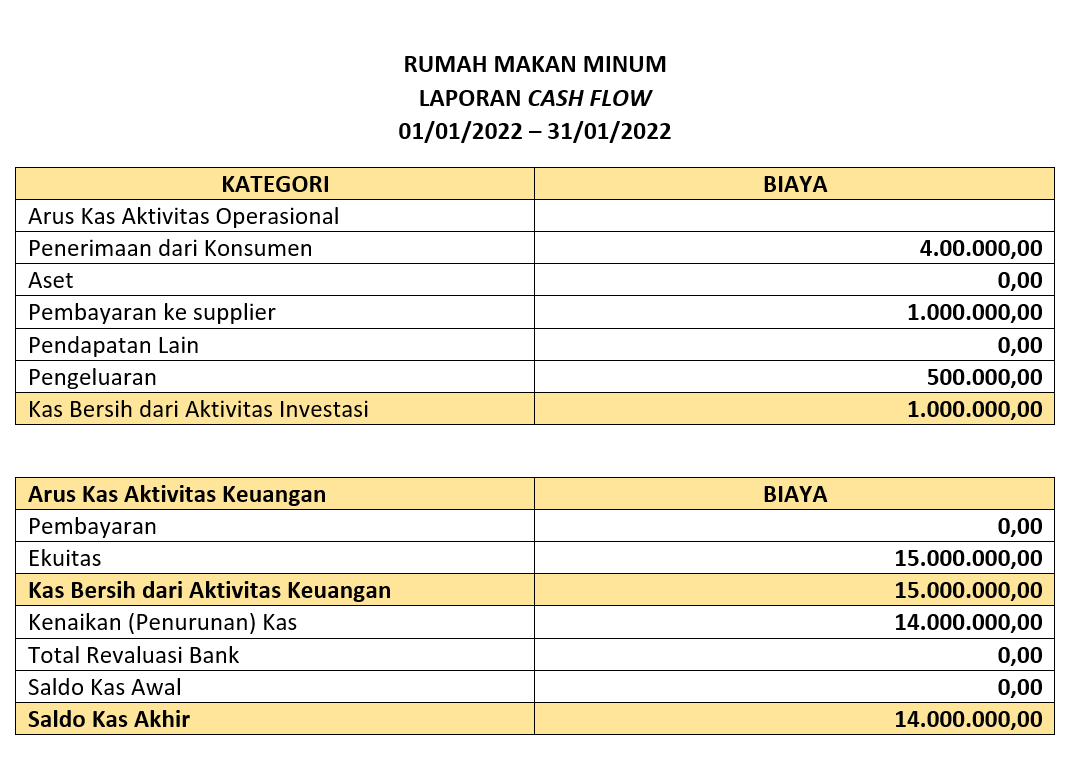

The brand new analogy in Contour 1 depicts this aspect. Triplets James, John, and you can Jack graduate school and head to work at an identical organization, although around three employ various other later years discounts procedures. James puts $2,100000 per year out-of age twenty five-65 on the his domestic safe. John invests $dos,100 annually out of age twenty-five-45 following comes to an end. Jack spends $dos,100000 per year for the holidays having 2 decades immediately after which spends $dos,000 a-year out-of years forty five-65. Each other Jack and you will John located six.5% attract compounded a-year. Exactly what will its old age finance look like once they every retire on decades 65?

Figure 2 reveals the way the exact same financial support regarding $2,100 develops more than an excellent 10 to thirty year several months which have returns ranging from five so you can nine percent.

For those who sign up for your 401(k) intend on a beneficial pre-tax foundation https://paydayloansconnecticut.com/ball-pond/ and take that loan out of your account, you are purchasing your self right back to your a later-taxation foundation

six. Financing when you look at the an excellent 401(k) plan can be a two fold-edged blade. After you retire and you will spread your bank account, you’ll have to shell out taxes once more.

For those who terminate work having an excellent loan, if you find yourself your bank account balance could be eligible to remain in the newest bundle, the loan have a tendency to standard if you’re unable to afford the count in the complete before the end of one’s elegance period.

You’ll want to understand that deleting your own hard-won money from the 401(k) bundle decreases the length of time that money was accruing money and you will compounding appeal. Please take time to think about the effects ahead of asking for financing from your own 401(k) account.

7. You might not qualify all of your account balance in the event that you terminate or take a shipment.

Read more