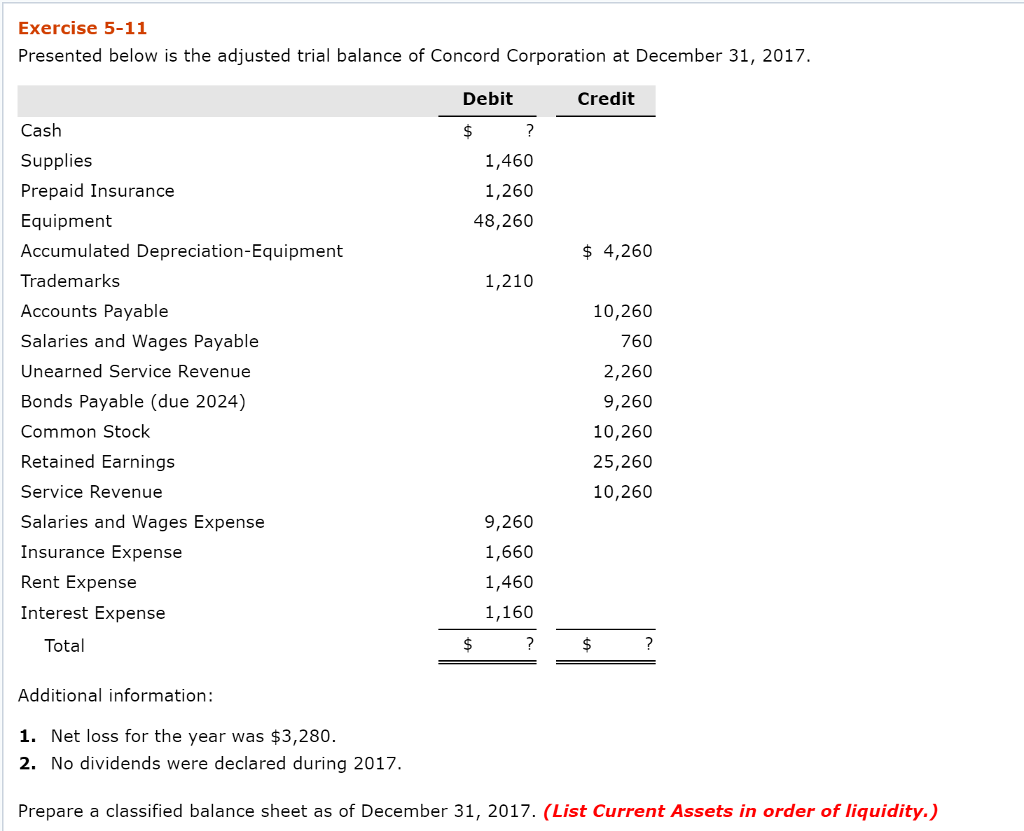

The united states Discount

This new regarding Bureau from Labor Analytics means that the newest You.S. discount continues to cool, with additional 0.2% when you look at the age as in July. New index having coverage rose 0.5% and you will was previously again area of the foundation to your escalation in the products. August’s CPI is actually 2.5%, the littlest a dozen-day raise because .

Following the discharge of CPI investigation, financial avenues in the us is cost inside a good chance of Given reducing cost on the September eighteenth. This may force the newest BoC for further price incisions as the rising cost of living in countries eases. All of us production always force Canadian thread yields down, hence minimizes fixed financial price borrowing costs.

The new COVID-19 shutdown of your economy and offer stores improved the new consult to possess much-necessary provides. Our demand outstripped have that have lower interest rates and much more extreme online installment loans Iowa cash circulates, starting highest rising prices. Because the rising cost of living is actually good lagging indicator, and you may Analytics Canada actions rising prices in different ways to own resales off current belongings, it became apparent you to rising cost of living try rapidly running rampant. Thus, the fresh BoC been ramping within the benchmark key rules rate of interest to control rising prices rapidly.

What is different on the these speed grows inside early in the day inflationary schedules? On the 1980s, we didn’t have a similar financial obligation levels. Today, Us americans create $1 per $step one out of personal debt, if you’re Canadians build $step 1 each $1.65 away from personal debt. Americans weren’t once the in financial trouble as with the mid-eighties. Say you had a great $100,000 financial, along with your income typically is actually doing $20,000; the newest payment on the home loan try likely less than $845 within 10% should you have an effective 35-seasons mortgage or, state, $step one,604 if cost risen to 20% thereon same mortgage. Credit cards and HELOCs just weren’t put normally in the past, thus financial loans try more than likely anything you had.

Given that rates jumped of ten% so you can 20%, their attention perception twofold (magnification from 2x). But not, now the outcome would-be much more magnified. A performance boost off 0.25% so you’re able to 5.00% towards the BoC’s Secret Rules Speed form good magnification out-of 19x towards the interest element of your homeloan payment. That implies to your a twenty-five-year financial, their $100,000 mortgage’s monthly payment do jump away from $436 to $716. The major difference between 2024 and you may 1982 is that we zero offered have 35-seasons prime mortgage loans having average domestic costs near $72,800 and you may mediocre financial harmony hovering as much as $41,two hundred.

Navigating High-Rates to save cash on your Home loan

Because the complete effects of past rate of interest hikes is felt, user request will be influenced. While the demand drops, thus also is to costs, and navigating these to spend less is determined by your situation.

Exactly what rises need go lower, however it may not get smaller prompt sufficient for all. Home loan costs was projected in the future down, but prices may well not come down very well linearly, as you are able to bond give upticks can occur on the longer-title refuses.

Which have $900 mil when you look at the mortgages coming getting renewal across the next lifetime, people having to replenish is always to arrange for commission amaze within the Canada. Commission wonder you certainly will next restrict home spending plans and you may unknowingly cause an excellent further reduction in fixed prices.

Making use of Repaired-Speed Mortgages to minimize Rate of interest Chance

Antique thought is to try to lock on your own towards a fixed-rate home loan from the earliest sign of price hikes. However, if the rising prices try a good lagging indicator and you can bond productivity was a leading basis, then waiting for suitable second to help you lock in is the most suitable treatment for proceed.

A calculated experience to put you to ultimately make use of all the way down prices. This is actually the best bet for anybody navigating this tumultuous speed ecosystem. With regards to the BoC, it basically takes 18 to help you a couple of years so you can acquire rising cost of living, thus using this schedule, we are overdue observe prices start to development off. Riding your mortgage into a smaller repaired term will be a good idea if you need stability and you may predictability with your mortgage repayments.