In the present Canadian housing industry, the term Home improvement Financing is good beacon for homeowners trying to improve their property’s well worth and you can visual appeal.

A house improvement mortgage , once the identity indicates, are often used to money a range of household home improvements and you can improvements. Because of the making use of these types of info, property owners inside the BC, Canada – and you will past – can cause its fantasy belongings if you’re concurrently improving the value of the capital.

Such as for instance recovery funds are typically provided based on the existing equity of your home. Guarantee, in this perspective, is the difference between the modern ount you borrowed on the financial. The greater number of collateral you’ve created, more resource you could potentially potentially secure to suit your renovations.

Why does this dilemma? While the committing to your house will not just add a bit of private style otherwise build daily living more enjoyable. it may significantly enhance your property’s market price. Home improvements is also modernize your area, improve possibilities, and you may raise energy efficiency – every important facts to have audience.

Also, within the an extremely aggressive housing industry like BC, Canada, this type of improvements deliver your residence a plus, making it more attractive so you can potential customers otherwise clients.

But house renovations aren’t a single-size-fits-most of the services to enhance worth of. New affect their home’s value can differ according to the types of and top-notch the newest recovery, the brand new construction market’s ongoing state, and you can regional client tastes. As a result of this it is vital to smartly bundle their renovations, centering on those that supply the finest Roi (return on investment).

Understanding Home improvement Money Within the BC, Canada

Domestic equity money provide people the mandatory financing to enhance their features, off lesser otherwise graphic advancements particularly decorate and you may floor to architectural variations such space improvements otherwise complete remodels.

Since the reason for such money are many, you to definitely secret objective unites them: boosting an effective property’s features, aesthetic interest, and you can complete worthy of.

On the state of United kingdom Columbia (BC), Canada , the genuine house market is extremely competitive. Keeping or improving a property to match industry styles is very important. This is where home improvement money considering home guarantee step in the.

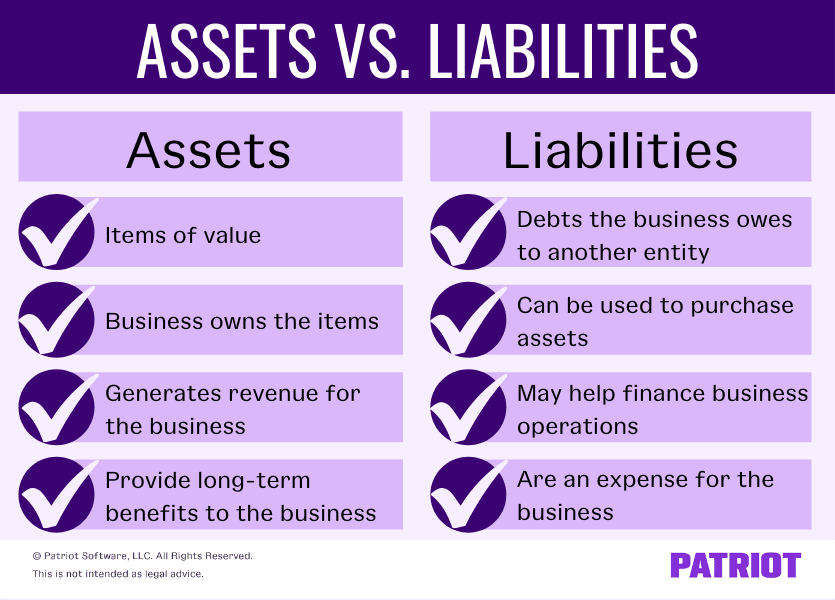

Family equity ‘s the difference in the present day ount of any funds secured by your home, instance a mortgage. Because you make costs on your own mortgage, you build security in your home. In a flourishing housing market such as for instance BC, rising assets opinions also increase your house guarantee.

Family security performs a vital role home based home improvements financing , especially household security funds and you will house security credit lines (HELOCs) . In BC, Canada , of a lot home owners decide for home guarantee money due to their reounts dependent into worth of their house’s guarantee, often at the lower rates than personal loans otherwise credit cards.

Having a home guarantee mortgage, home owners can obtain a lump sum to pay for price of its reount capped because of the collateral in their house. When your guarantee was assessed, loan providers during the BC, Canada, generally allows you to use to 80% of your home’s appraised worth – with no number you still are obligated to pay on your financial. Only just remember that , the upper limit regarding 75%-80% is on a situation by the case foundation.

Best Developments To increase good Property’s Worthy of

The value a remodelling adds to your residence isn’t really universal. Certain enhancements commonly produce a top return on investment. The essential valuable renovations are kitchen upgrades, toilet home improvements, landscaping developments, and effort-productive improvements.

Home Updates

The kitchen is often the cardio away from property. Improvements in this place, away from starting modern equipment to redoing the new cabinetry or adding a great practical kitchen installment loans for bad credit in Reno isle, is rather improve your property’s desire. A modern, well-equipped cooking area is actually a primary feature, to make your residence more attractive in order to potential buyers otherwise clients.