Share:

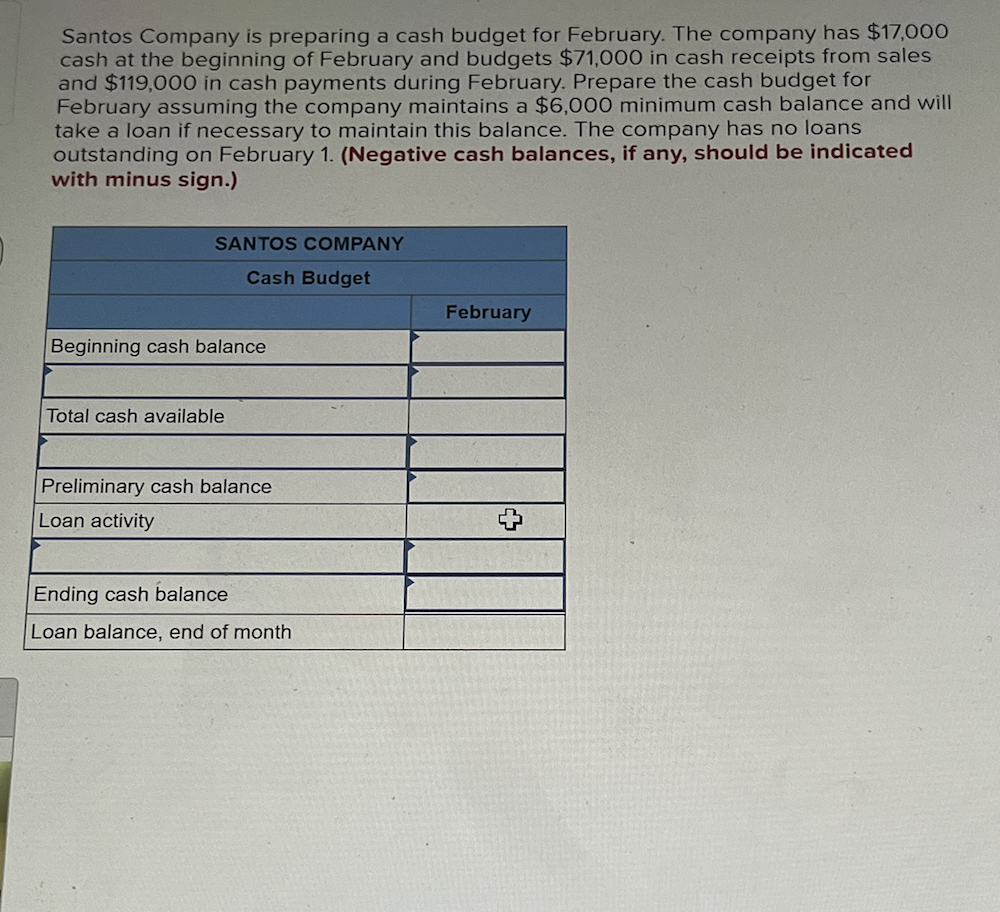

Chairman Obama is actually overall his latest title with an aspiring FY-2017 funds suggestion towards the fiscal approaching year. Brand new funds functions as a statement of one’s administration’s policy and you may financing goals. The fresh budget solidifies the latest Administration’s dedication to expanding americash loans locations in Saybrook Manor potential for individual developers to build houses inventory that is affordable to prospects and you can group anyway income levels and you can improve the quality of existing federally-helped property. It tries to strengthen the low-Income Housing Taxation Credit (LIHTC) and This new s. In addition it proposes highest financial support levels for several key You.S. Agencies regarding Property and you will Urban Invention (HUD) applications.

Tax Credit Applications

The fresh new Obama Administrations wanted similar LIHTC system alterations in the FY-2016 recommended funds. The fresh budget would develop states’ LIHTC expert by allowing them to transfer to 18% of its personal pastime bond regularity cover with the 9% LIHTC allocations. The fresh new budget would get rid of the cover for the amount of qualified census tracts you to HUD normally specify.

A new series of proposed changes manage connect with states’ Licensed Allotment Agreements. States might possibly be expected to were both affirmatively promoting fair housing because an explicit allocation preference in addition to preservation away from federally-aided sensible homes because a selection expectations. Again, the fresh finances implies using a full time income-averaging signal to decide a project’s compliance having income qualification guidelines to prompt earnings-combination inside the features.

Brand new suggested FY-2017 budget tries a permanent extension of your program and you can $5 million within the allocating authority from year to year. It would in addition to create NMTC in order to counterbalance Solution Minimum Income tax liability. This offer mirrors the only shown on the President’s FY-2016 suggested budget.

The brand new funds suggests the latest income tax borrowing from the bank, that is directed at teams that don’t always be considered while the low-earnings organizations, but which have suffered otherwise be prepared to endure an economic disruption right down to a primary employment losses experience, such as for instance an army feet closing or factory closing. This new National government along with brought so it taxation credit inside last year’s recommended budget. People into the credit was expected to consult with associated Condition otherwise local Economic Creativity Businesses (otherwise similar organizations) in selecting people assets one to qualify for the credit. The credit could well be planned using the system of your Brand new Avenues Tax Borrowing from the bank otherwise since an allocated financial support credit like the new taxation credit having investment during the qualified assets used in an excellent being qualified cutting-edge times development venture. The proposition would offer about $2 billion in credits for licensed investment recognized in every one of the 3 many years, 2017 through 2019.

Create The usa Ties was a lower-cost credit device to possess County and you can regional governments that were enacted included in the American Data recovery and you can Reinvestment Operate out of 2009. The united states Punctual Give Bonds perform create up on the brand new effective example of the newest Create The usa Bond program by giving another bond program that have greater uses that focus the brand new resources of money for system financial support. And plus financing to own area 501(c)(3) nonprofit organizations, eligible uses include investment to your sorts of systems and software which are often financed that have licensed individual interest bonds, subject to the applicable State bond volume caps into the licensed private activity bond group. The latest offer could be energetic to have securities awarded after .

U.S Agencies out of Casing and you can Metropolitan Invention Software

According to Assistant Castro, the biggest area of the HUD finances is actually seriously interested in supporting the fresh family members whom currently inhabit federally-aided houses. Consequently, President’s FY-2017 HUD finances reveals improved funding for a couple trick programs.

This new finances suggests heavier financial support in this system having an excellent sixty% boost in financing accounts from last year. Which additional investment do support execution provides half dozen this new Alternatives Communities, as well as approximately 15 the fresh Promise Neighborhoods, and various most other considered gives to have teams.