Whether you prefer a financial increase, need to combine large-focus obligations, otherwise bridge the fresh pit between opportunities, the crypto lending program gives you access to immediate cash.

Figure Financing has actually started $7B+ during the funded fund, including crypto-supported financing, and also never destroyed money property otherwise paused crypto withdrawals.

All of our infant custody-only equipment allows you to keep beneficial ownership of one’s security, that’s kept on a qualified caretaker and won’t getting rehypothecated.

You could potentially borrow up to 55% of property value their crypto from the an aggressive speed and you will prefer to create month-to-month appeal-only costs more their a dozen-week identity, otherwise delay desire up to maturity. Either way, the remainder equilibrium of one’s loan plus people accumulated notice try owed entirely within readiness or even always replace the loan to have a 1% origination percentage. As soon as your mortgage try paid in full, people leftover collateral would-be gone back to your.

There aren’t any constraints as to what your own crypto fund can be employed for. Many users use the liquidity to possess high orders including a property, car, otherwise travel, while some ent or a lot more crypto property. no credit check personal loans Cleveland MO Figure cannot give monetary information so we strongly recommend you get in touch with debt coach about how exactly the new proceeds might be greatest made use of.

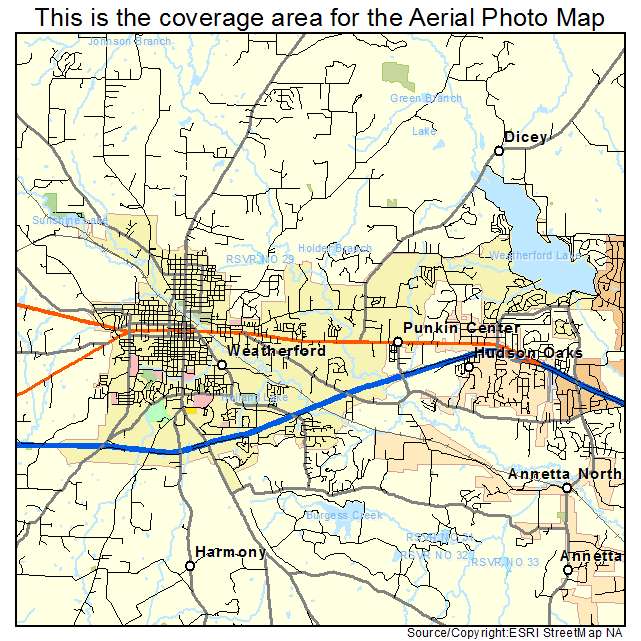

Figure’s Crypto-Supported Financing is present so you can residents of any state except Idaho, Illinois, Kentucky, Maryland, Mississippi, Southern Dakota, Colorado, North carolina, Virginia, and the Region of Columbia, so we are working to grow these types of metropolitan areas.