There are usually several conditions that must definitely be fulfilled before a borrower can refinance their residence ec-refinance-hl000061 . Including, specific mortgages has a set several months before you’re allowed to implement to have refinancing or to improve the financial. And only including taking out the initial mortgage, there are more qualifications related to the new borrower’s monetary profile – such as shedding within this a particular credit rating assortment. If you’re worried your credit score could possibly get effect your capability to help you re-finance, there is certainly a few a method to however get it done.

What is a credit score?

Your credit rating try a great about three-fist number which is computed predicated on your credit report. Credit scores cover anything from 3 hundred850 and will end up being categorized regarding poor so you can advanced. Your credit rating is short for your own creditworthiness – the latest the total amount that a loan provider considers someone compatible to get that loan, have a tendency to for how reputable these are generally to spend it right back. Serve it to state, your credit score sells some weight whenever obtaining financing, but it’s maybe not the one thing you to determines your loan qualification. Before dive in, you may check your credit score to understand in which your sit.

What credit score is required to re-finance my personal financial?

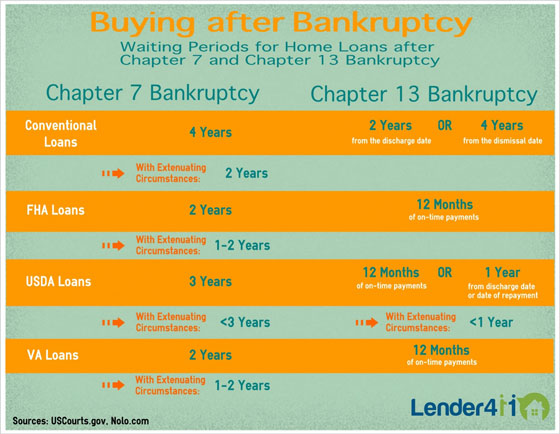

There’s no one-size-fits-all approach in terms of just what credit history you want so you can re-finance your mortgage as it hinges on the lending company and you may what kind of re-finance you are looking to accomplish. The credit get required for a normal financing re-finance, such as for example, may look different than the financing rating necessary for an FHA fha-mentioned-hl000046 or Va mortgage ec-va-hl000068 re-finance. And your credit score, there are many circumstances that might help assistance your loan candidacy.

- Number of household guarantee you have collected, labeled as your loan-to-value proportion the latest appraised worth of property as opposed to the mortgage count

- High asset reserves

Regardless of if such additional factors aren’t certain to make it easier to refinance that have a low credit history, they may assistance the application.

An approach to refinance that have a lower credit rating

Those with lower credit ratings get 1st find it hard to pick a great refinancing choice that works in their eyes. If you find yourself in this situation, speak with your financial. They may help to build an activity plan otherwise suggest examining some of the after the:

Conventional compliant refinance

The ability to re-finance and keep a normal mortgage are tough with less credit score due to the fact conventional fund want a good so you can higher credit scores to help you each other acquire and you will re-finance. Consult with your current financial concerning your solutions. You can even believe refinancing their old-fashioned loan to https://paydayloancolorado.net/hotchkiss/ have a keen FHA mortgage for people who qualify.

FHA rates and you will label refinance

FHA rates and you will title refinances are usually value investigating in the event your credit history has brought a knock. It change your loan name and you may interest, that can help you save money. Such refinancing and accepts all the way down fico scores than simply traditional mortgages.

FHA streamline refinance

FHA streamline refinances is actually for people who already hold FHA money and would like to refinance to reduce their attention price otherwise eliminate the loan’s term size having shorter papers and you can a lot fewer will set you back than just a timeless refinance deal. FHA improve refinances don’t possess the absolute minimum credit rating demands, however they possess criteria pertaining to homeloan payment background to your the borrowed funds are refinanced. On occasion, lenders may need more borrowing requirements apart from what is necessary because of the FHA, regardless if this is simply not regular for it particular system. credit-score-for-refinance_disc1

Va loan re-finance

For individuals who actually have an excellent Virtual assistant loan and you can still fulfill the brand new eligibility official certification, a great Va financing improve re-finance – labeled as mortgage Avoidance Home mortgage refinance loan (IRRRL) – are a chance to speak about.

- You currently have a great Virtual assistant financing, and you may

- You may be by using the IRRRL to re-finance your Virtual assistant loan, and you can

- You might certify that you currently are now living in otherwise always live in the house protected by the mortgage.

Complete, Va fund generally bring all the way down credit history conditions and offer competitive cost as compared to FHA and old-fashioned money. New Va re-finance program is sold with a keen IRRRL plus 100% cash-out re-finance alternatives.

The application form will get lower your monthly mortgage repayments because of all the way down attention prices or is also disperse your loan off an adjustable so you can a repaired rate of interest.

Enhancing your credit history

Because you comparison shop for different a way to re-finance which have a great down credit score, believe attempting to improve your credit rating throughout the years and trying to get that loan refinance afterwards.

Basically

The financing get needed to re-finance a home depends on the brand new financial additionally the style of re-finance you’re looking to accomplish. When you’re worried about your credit score inside your qualifications, there are many more measures which can be worth investigating. Envision talking to your existing financial observe exactly what choice get be accessible for you.