- Bridgework

Breastfeeding home-care

Which save is applicable on highest rates cash taxation you spend. For those who pay the higher rate from income tax, the better speed away from forty% relates to income which is above the fundamental price clipped-out-of point. The breastfeeding home expenses you only pay is actually subtracted from your overall earnings, reducing the quantity of your earnings that is nonexempt in the higher rate. Funds provides samples of tax save toward medical household expenditures.

For folks who take advantage of the newest Fair Bargain Breastfeeding Home loan, your otherwise the estate can be claim tax recovery when the financing is actually paid off. this is after you offer new asset that has been put as the security otherwise when you die.

House medical

You could potentially allege recovery on the cost of using a qualified nurse in the home within standard rates out-of 20%.

You could claim income tax rescue toward following expenses when your youngster need lingering or normal healthcare worry and they’ve got:

- A disease that’s life threatening

- Malignant tumors

- A permanent disability

Telephone: In case your child is addressed home, you could claim a flat rate recovery to pay for cellphone rental and you may calls that are personally pertaining to the therapy.

Quickly hotel: If you are the mother or father otherwise protector and you’ve got so you’re able to remain near the health at once to suit your infant’s cures, you could potentially allege save some bucks of your own hotel.

Travel: Having trips required to the treatment of she or he, you could claim for going to and you will of medical, towards the will cost you of youngster plus the parents or guardians. There is certainly an usage allocation if you utilize a private vehicle.

Health services unique outfits: You could claim to five hundred to possess health products and unique gowns you’ll need for your own infant’s medication.

Health insurance

Its not necessary so you can allege the save its given as a decrease in the level of the fresh advanced you have to pay. This really is called taxation rescue at supply.

However, in some situations taxation recovery at the origin will not pertain, such as for example, where an employer will pay the medical insurance fees on behalf of a member of staff. This is handled given that a benefit into the Kind and you may income tax are due into total count.

Thus new personnel doesn’t the newest income tax relief in the supply on the insurance premium. You might rather make a claim to Cash.

The fresh new save is provided with from the price from 20% of your costs. It is around a total of step one,000 for every single mature and you will five-hundred for each and every youngster. An infant is actually some one significantly less than 21 yrs old that a good child advanced could have been taken care of.

Costs

But not, tax relief to your nursing family costs would be stated at your large rates from income tax. This means that the fresh part of your income which is taxable at your higher price from taxation are faster.

How to apply

For those who gotten medical care in one single year however, paid for they the coming year, you could will allege the fresh new recovery to possess sometimes season.

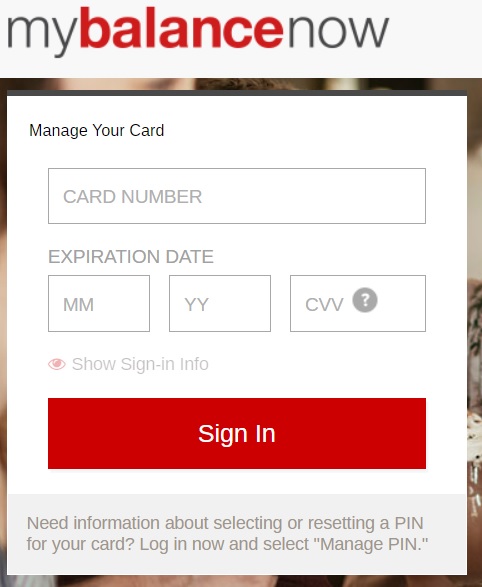

Pertain on line

In the event the was a self-reviewed taxpayer, have fun with Revenue On line Solution (ROS) and you will complete the wellness expenses part on your own yearly loans in Tashua Taxation Come back (Form eleven).

Receipts

You can simply claim getting scientific expenditures for those who have receipts to show your own claim. To have dental costs, their dental practitioner is over Form Med 2 (pdf) for you to use since an acknowledgment.

Revenue’s myAccount solution includes an invoices tracker services which allows your to store their receipt information on the web. When you use this particular service, you could allege taxation rescue within the Real time Borrowing service. As a result you could potentially allege having fitness expenses and you may breastfeeding domestic expenditures after you outlay cash and just have enhanced tax credit on your own second payroll fee from the company. You could make a real time Borrowing from the bank allege playing with myAccount.