Understand the loan’s cash flows and you may said need for columns A beneficial and you will B in the Exhibit step three

3. With the upright-line amortization means in the place of guaranteeing properly that the email address details are uniform which have Statement zero. 91. Like, Heritage Bankshares, a financial inside the Virginia, said within its 2004 function ten-KSB one to inside misapplying FAS 91, prior to the restatement, the firm amortized deferred net charges/can cost you only using brand new straight-range method rather than utilising the height-produce means in which suitable.

4. Relying on multiple tips guide computations regarding the implementation of Declaration no. 91. Such as, spreadsheets and no controls, auditability effectiveness or capacity to track government bypass are commonly made use of from inside the amortization calculations. For example instructions tips might be substituted for auditable and you may automatic assistance.

Using Statement zero. 91 can be very difficult getting bonds having complex dollars flows, such as mortgage-recognized securities that have hidden Sleeve or hybrid fund, tranches into the collateralized financial debt (CMOs), interest-simply (IO) pieces otherwise dominating-just (PO) strips, just like the prior and you can asked coming cash flows ones securities need certainly to meet the requirements so you’re able to compute amortization of your own superior otherwise write off.

The initial financing basis (or carrying number) is actually $99,000

5. With accounting work marketed during a business instead of sufficient control. This really is a common routine and poses dilemmas if the facilities have poor regulation and should not enforce their accounting formula. Instance, it could be the responsibility of the procedures agency to assign ideal bookkeeping classification from charges. However, instead of tight controls and you will intimate coordination on bookkeeping agencies, charges are classified defectively by the operations department and you will located incorrect accounting therapy.

six. Collection loans Laurel finance by the addition of its internet charges and you will amortizing the fresh new aggregate net payment, rather than starting the brand new amortization on the net payment of every mortgage by themselves. Which labeled approach keeps one or two chief issues. Very first, based on Statement no. 91, part 19, loans can be classified only when the school keeps a big quantity of finance that have similar services (loan kind of, loan size, interest, maturity, venue from security, go out away from origination, questioned prepayment rates, an such like.). It is difficult just like the bookkeeping remedy for fund that cannot be placed when you look at the a group may differ off grouped finance. 2nd, it is difficult to audit the newest grouped strategy securely as the grouping methodologies are very complex.

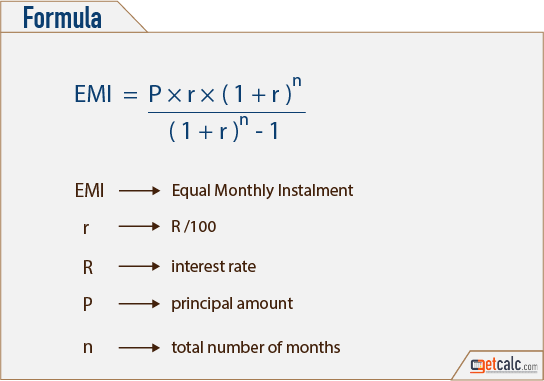

Analogy. An excellent ten-year financing having $100,000 provides a predetermined price of five% on the first couple of many years and you can a varying rate of primary along with 1% into remaining eight ages. On origination, perfect is 6.5%. Centered on Declaration zero. 91, the web payment out-of $step 1,000 is actually deferred and you may amortized. To possess convenience, believe that it financing need yearly repayments so there are not any prepayments.

In the event your effective-give method is used mechanically, the interest earnings and you will amortization numbers in columns C and you may D are acquired. To possess analysis, the costs acquired within the upright-range method get in the articles C* and you will D*. Observe that into the seasons step 1, under the active-give strategy, the lending company brings in a cost more than the web fees, because amortization out-of $1,705 is higher than internet charge from $1,000. Declaration zero. 91, paragraph 18a, corrects this by the limiting amortization; see the overall performance lower than Declaration zero. 91 for the columns C’ and D’. Plus note that, within analogy, the internet commission is accepted completely after the brand new first year in the place of along the lifetime of the borrowed funds, as well as usually the case in energetic-interest approach. Instances along these lines that, where in fact the mechanical applying of new active-notice means results in the newest recognition of a high matter than just the actual fee, exists if need for the first decades try substantially all the way down than in advancing years. Finally, notice the latest good differences one of several about three techniques. Hence, applying the active-yield approach mechanically is not always inside conformity that have FASB Report zero. 91. Particularly, lenders whom originate a large number out of Palms or hybrid financing will be capture a closer look from the how they calculate amortization and you may acknowledge charges regarding the origination of such loans.