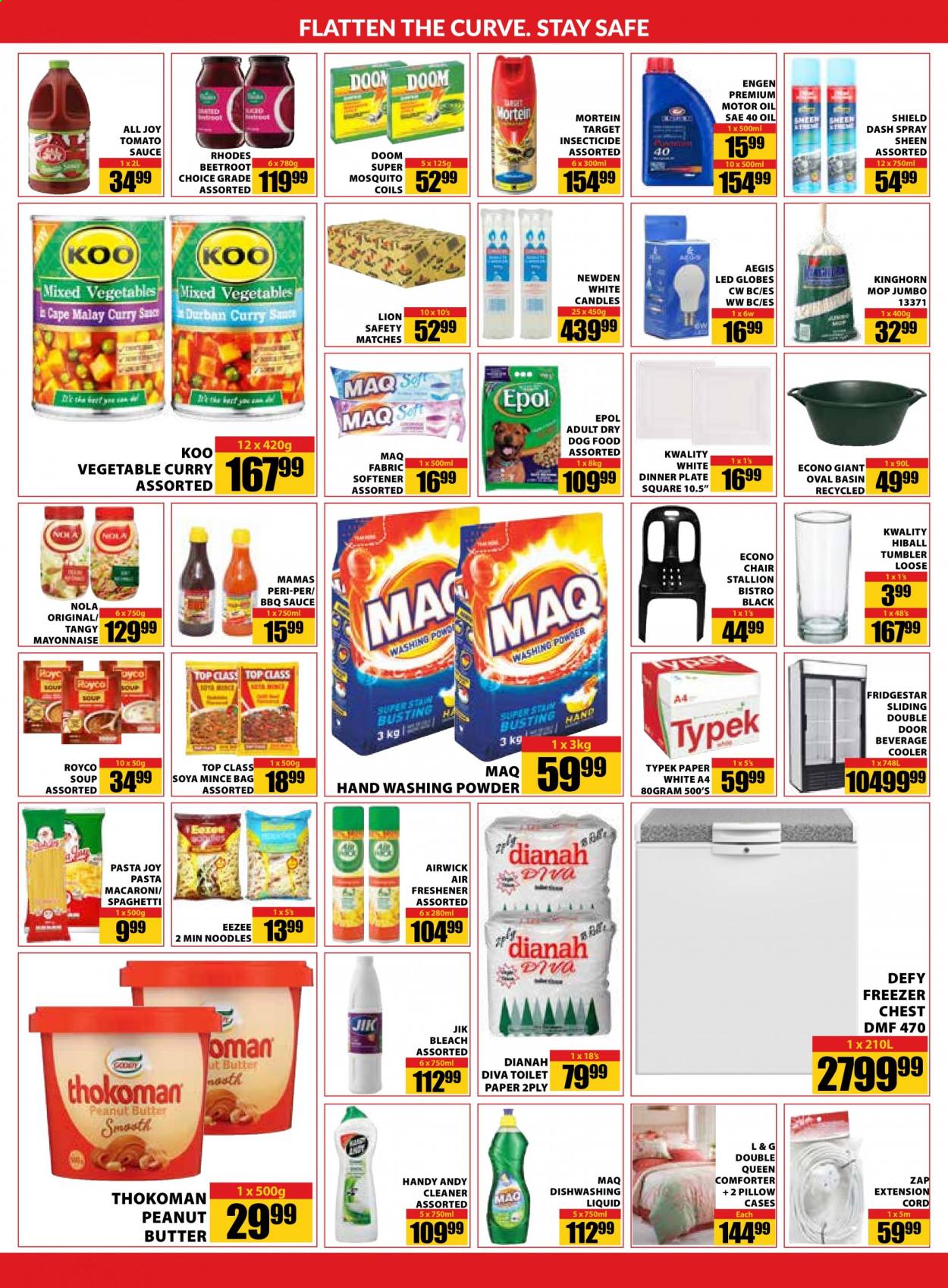

To the Federal Reserve’s recent action to lower brand new federal fund rates and you can home loan rates popular downwards lately, the eye mentality is actually flipping brand new spot. Thus, of several home owners who had been waiting for straight down pricing have tapped within their home’s security for money.

Because the domestic equity finance is protected by the house, they often times come with way more good rates than just playing cards and private loans. A property security mortgage refinance are going to be a smart solutions in the event that your existing loan has a higher interest rate than what is offered today. At the time of Oct 15, the average household collateral loan rates are 8.36%.

Even a little rate lose off 50 % of a time so you can an effective point get save you thousands of bucks more than your financing title, according to your loan number, lender or other factors. In case you’re thinking about that one, there’s something you must know just before proceeding.

Look around to discover the best price

Consider, house equity loan cost can differ commonly from financial to help you financial. As a result, it makes sense examine quotes out-of multiple lenders to evolve your odds of getting an educated re-finance interest.

According to Aaron Gordon, department director and you will elder mortgage manager in the Guild Financial, skipping so it vital action is one of popular mistake homeowners generate. “Start by the lending company otherwise borrowing union you may have a recently available banking relationship with and get in touch with a few other non-lender lenders.”

Household equity and you will credit score matter

As the Gordon cards, your house collateral and you may credit rating plus foundation greatly with the re-finance rate you receive to the property equity loan. Large fico scores essentially end up in a whole lot more good rates-the low, the greater. Yet not, you might nonetheless refinance which have less credit history, however your price could be higher.

“Household collateral lenders check your credit history together with amount out of family collateral you have when costs your loan,” he says. “More security you can easily kept in the home next mortgage will bring you a much better price.”

Overborrowing have major consequences

After you re-finance, you fundamentally pull out a different sort of financing at a diminished rates than your that. At this time, that have costs falling, it may be tempting so you can overborrow. Household guarantee funds and you can lines of credit are believed next mortgage loans that use your home because security on the mortgage. For that reason, your own financial you can expect to foreclose at your residence for folks who fall behind on your own costs. That’s why it’s important never to overborrow, even from the the current straight down prices, also to make sure you is easily afford the monthly payments.

“A home equity financing shall be a strong unit in making thorough and you will expensive improvements to your residence to help you develop incorporate value towards the property, nevertheless can very risky or even done safely,” states Alex Beene, an economic literacy teacher toward School of Tennessee in the ount borrowed must be under control and pretty easy to invest straight back over the years at your present income top.”

Other considerations

Domestic collateral fund are a popular credit alternative, to some extent because you can make use of the currency to alter their financial character. Of a lot individuals utilize the financing in order to combine financial obligation or for household upgrade projects you to definitely enhance their home’s worth.

Because the Beene cards, “If you aren’t by using the add up to somehow include monetary well worth to your online worthy of, it is really not an intelligent decision. Home security will be a tool for making use of a lot more financial resources to increase their house’s really worth much time-name, on top of other things. Yet not, if you are searching within it simply a injection off dollars to track down what you need, you’re probably not doing it for the right explanations.”

The conclusion

Most loan providers will let you acquire doing 85% of one’s home’s really worth. However, extent you might obtain is account fully for your specific finances. Its imperative to acquire only what you can comfortably manage now as well loan places Berlin as over the mortgage name, even if the present lower prices allow it to be appealing so you’re able to withdraw a whole lot more security.

Matt Richardson is the dealing with publisher to your Handling Your bank account point to own CBSNews. He produces and you will edits stuff regarding private loans ranging from discounts so you’re able to paying in order to insurance rates.