Good credit in order to safe a mortgage loan will be a minimum of 650.

Your credit rating signals the creditworthiness, whenever you may be to shop for a house, their get can indicate a lot during the determining the borrowed funds, the interest rate, as well as the coupons you’re offered.

- To possess a normal financial, you will need to features a credit rating of at least 620. Anything straight down could possibly get deliver increased interest rate. Conventional financing provides all official certification, following the Fannie mae and Freddie Mac recommendations.

- FHA money become more versatile throughout the credit scores or other official certification. Insured of the Government Housing Government, needed a minimum credit history away from 580 and you can a straight down percentage only step three.5%.

- Virtual assistant funds are available to people in the brand new armed forces and their spouses. Covered by Institution out-of Veterans Points, of many loan providers require a score between 580 and 620 and sometimes don’t require a down payment.

- USDA financing is actually backed by the new Department away from Agriculture. Eg Virtual assistant financing, an advance payment isn’t always needed, even though very loan providers require a FICO score from 640 or even more.

- Jumbo funds are generally bigger than old-fashioned money and sometimes lookup for a credit score with a minimum of 700 as well as a massive down-payment.

- Make ends meet punctually- One of the greatest factors on your credit score will be your on-go out payday loan near me percentage record. Lenders wanted proof you could create repayments like magic and manage your financial situation responsibly. The percentage background is the reason thirty-five% of the FICO rating.

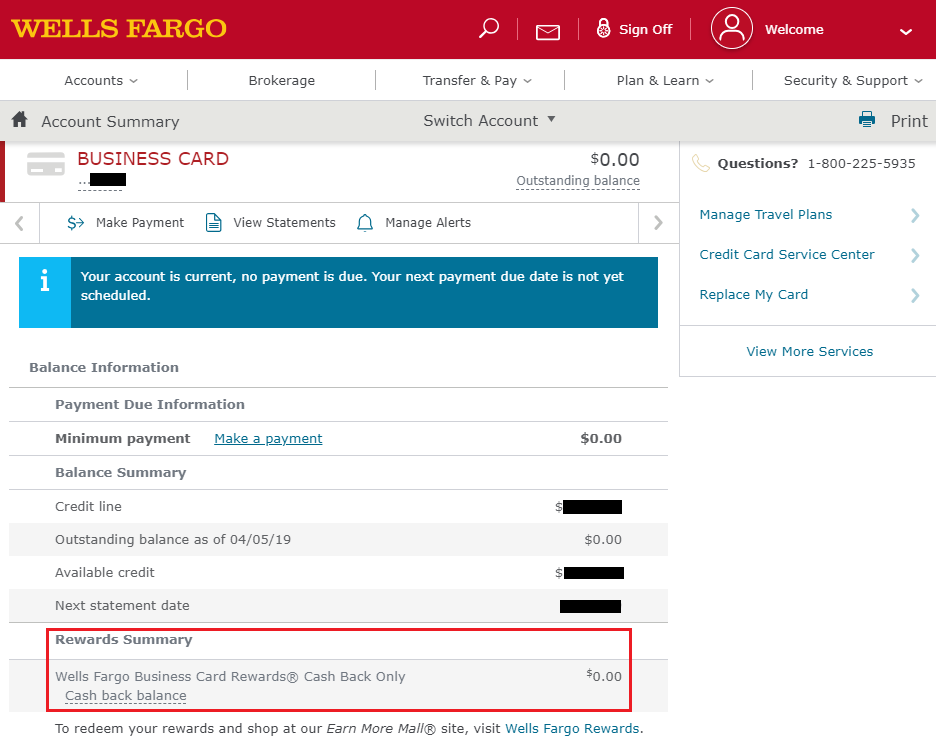

- Maintain lower credit application- Really it is strongly recommended using no more than 29% of one’s offered credit across the any cards. Your credit utilization is another big basis credit reporting agencies use to dictate the get.

- Track their credit reports- Check your credit file frequently. In the event the there are problems, file a conflict to your credit agency as well as your bank.

- Pay off debts- While holding financial obligation, reduce your own charge card balances. Mortgage brokers usually remark your debt-to-income ratio to determine when you can pay for home financing.

Our house you can afford as well as the sized their mortgage confidence numerous activities, from your own income toward personal debt toward size of the deposit, along with your credit score. It is additional for everybody.

The best place to start is by using pre-being qualified. Keep in touch with loan providers regarding your income, credit score plus prospective down payment. They’ll review their financials and you will, in the most common activities, render pre-qualifications to possess mortgage, outlining the dimensions of the loan they offer while the repayment terms and conditions.

Exactly what credit history is perfect for to invest in a property?

Immediately following you are pre-accredited, you will have a informed look at the house you can manage. Its a smart 1st step upfront domestic shopping. Bear in mind, compare terminology and you can interest rates.

Be mindful one pre-being qualified isn’t the same as a loan render. The new words might transform when you officially apply for the loan, mostly based your money and also the house we would like to purchase.

Vibrant is also make your coupons immediately. Vibrant increases their coupons from inside the typical increments, after the your goals, which means you initiate getting appeal ultimately. Set-up a beneficial Down-payment finance, and you may Bright can also be target their discounts for your house to invest in goal.

Which have Brilliant Credit Creator, you can get an easy borrowing boost. More about-day money was immediately made for your, and borrowing from the bank use is lower.

Without having they but really, obtain the fresh new Vibrant application throughout the Application Store or Bing Enjoy. Connect your bank along with your notes, place a number of desires and you will help Bright can functions.